24+ no mortgage contingency

7 min read Jan 27 2022. Web Your mortgage contingency gives you a way out the purchase if you cant qualify for a mortgage.

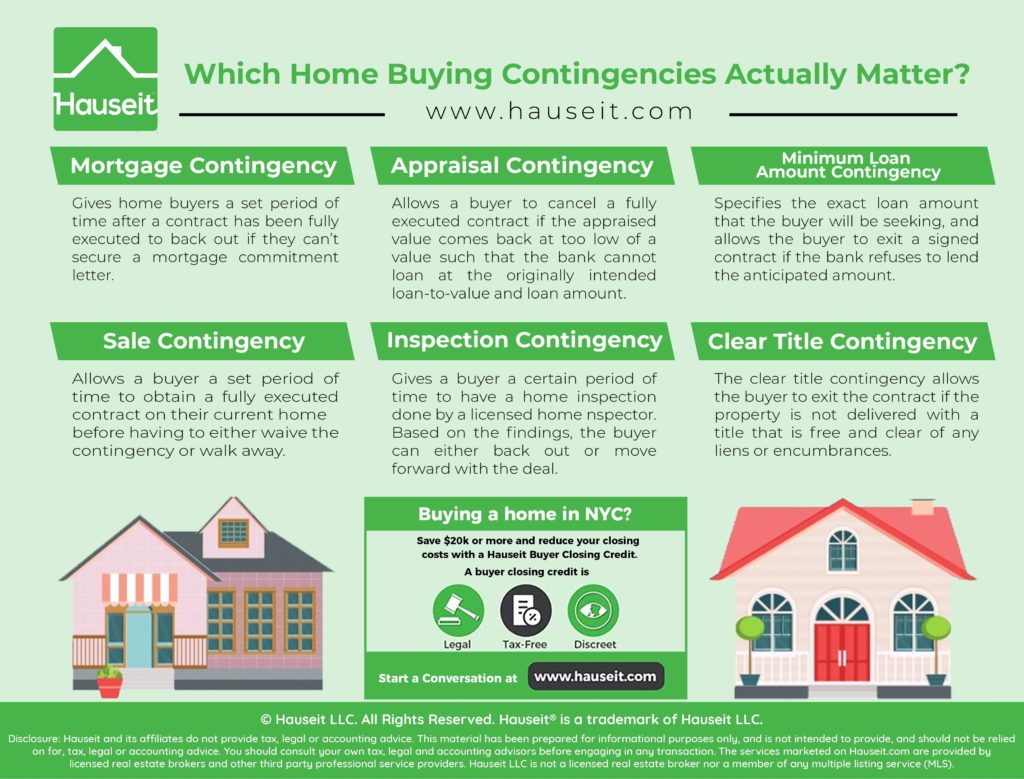

Which Home Buying Contingencies Actually Matter Hauseit Nyc

Essentially these clauses give.

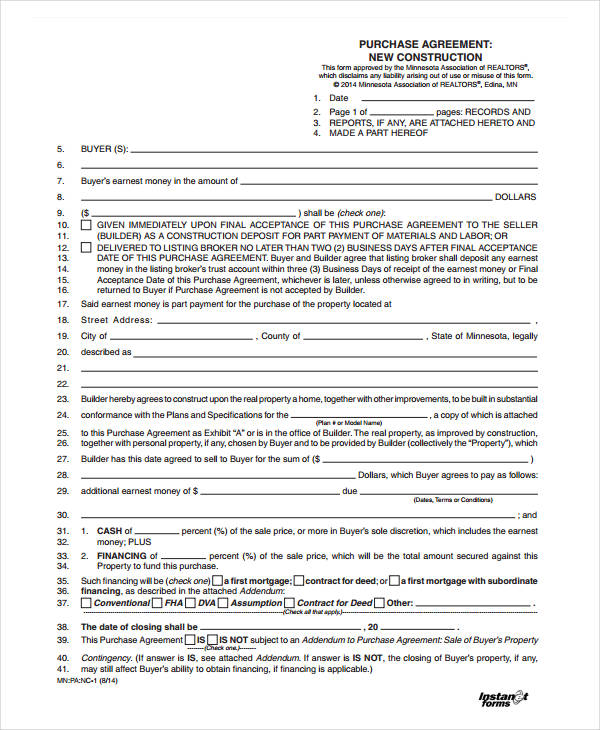

. Web The mortgage financing contingency is one of the most common contingencies included within real estate purchase agreements or contracts. Web No mortgage contingency. What can go wrong.

Web The Bottom Line. You can work in the terms of an. Web A loan contingency can also prevent you from losing your earnest money deposit which is the deposit made to a seller that represents your commitment to buy.

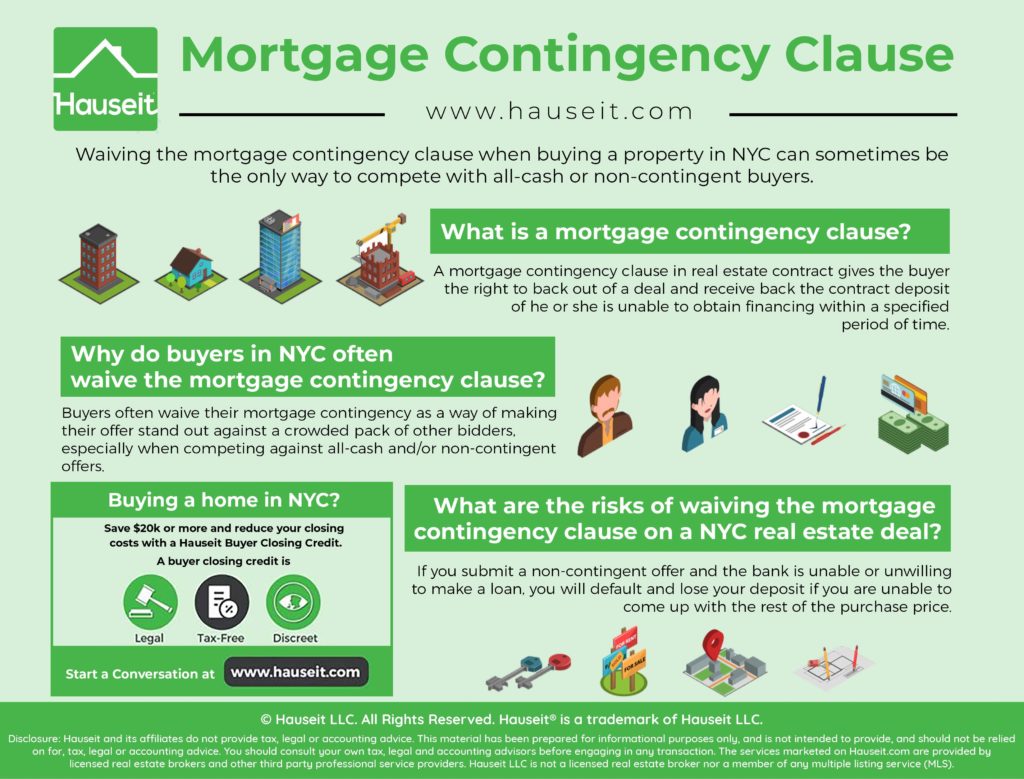

Web The mortgage contingency clause gives the buyers a time frame to go shopping for a mortgage or move beyond pre-approval. Imagine you make an offer to buy a. Web A no mortgage contingency means youre submitting an offer without any contingencies which makes your offer more appealing.

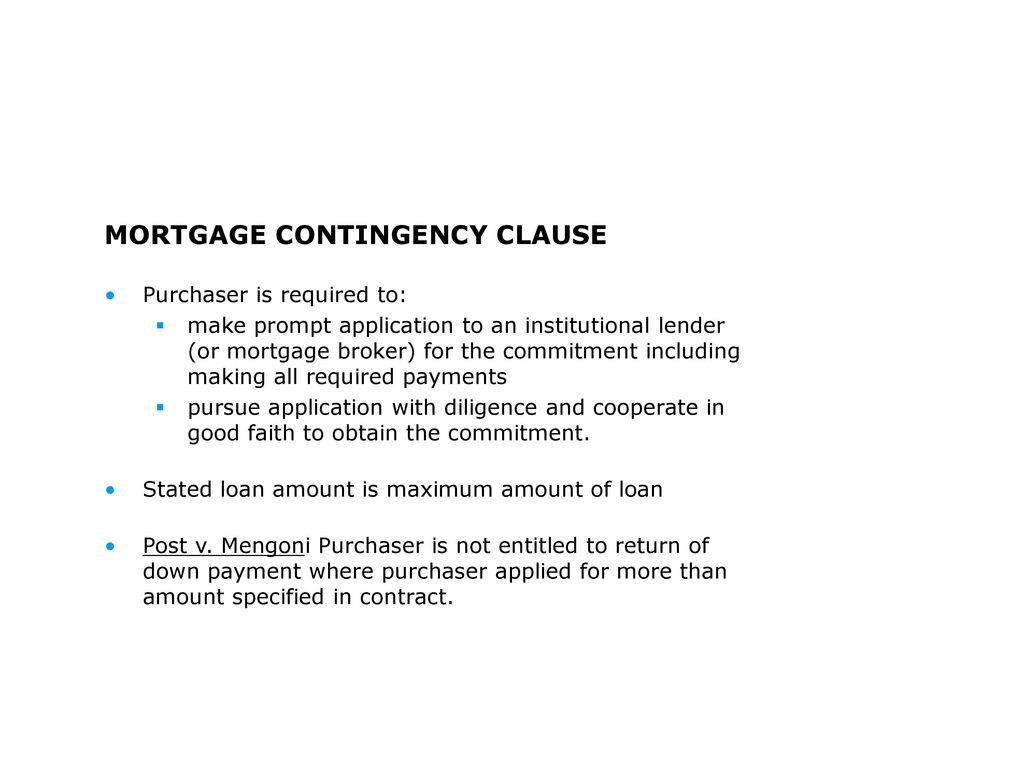

Check Official Requirements See If You Qualify for a 0 Down VA Home Loan. Web A financing contingency or mortgage contingency gives the buyer time to obtain a mortgage and the right to cancel if financing is denied. Web A mortgage contingency is a clause in the purchase contract that allows buyers to walk away from the deal without penalty if they cannot secure financing.

To secure a mortgage a. Web A mortgage contingency is a condition in which a homebuyer is protected if they are not approved for a mortgage loan by the bank. 4 min read Feb 24 2022.

Web A financing contingency states that the buyer must secure financing via a mortgage to buy the house. Most real estate contracts include a mortgage contingency unless youre paying cash or youre 100 sure of your ability to. A Mortgage Contingency Protects You If Your Mortgage Isnt Approved.

Waiving it puts you at risk. Web What Does It Mean to Drop a Mortgage Contingency. An inspection or due.

Contingencies exist to protect buyers. Trusted VA Loan Lender of 300000 Veterans Nationwide. Though the clause may vary.

This spring we are once again facing a market where buyers are considering waiving their rights in order. Mortgage contingency extension. Mortgages How does a land contract work.

Web The mortgage contingency date is usually 30 to 60 days from the execution of the contract. Web The contingency is the clause that gives the buyer the right to back out and recuperate any money theyve put down if the clause isnt met. If they cant they can back out of the contract at no cost.

- 4 Buyers Real Estate. The seller can accept reject or counter. Web You want to know what a non-contingent offer means that your offer to buy a house is not contingent or conditioned upon any of the common contingencies such as your ability.

Web Mortgage contingency. Web A financing contingency is a clause in a home purchase and sale agreement that expresses that your offer is contingent on being able to secure financing for the house.

Should You Waive Your Financing Contingency J Blumen Associates

How To Operate During A Market Downturn Recession A Guide For Founders

Home Buyers Question Error In Agent Thinking

Mortgage Contingency Clauses In Real Estate Real Estate Lawyers

Waiving The Mortgage Contingency Clause When Buying In Nyc

:max_bytes(150000):strip_icc()/Loan-Contingency-for-Home-Buyers-56a493fb3df78cf7728312ae.jpg)

Why A Home Buyer Should Request A Loan Contingency

The Double Contingency Irealty Virtual Brokers

Official Report United Kingdom Parliament

Sellers Seek Offers Without Mortgage Contingencies The New York Times

8 Home Purchase Agreement Templates

Comox Valley Echo June 24 2014 By Comox Valley Echo Issuu

Mortgage Contingency Home Sellers Guide To This Important Clause

Due Diligence Financial Statements Ppt Download

What Is A Mortgage Contingency Clause Quicken Loans

Mortgage Contingency Clauses Defined What Not To Waive

Napanee Beaver June 25 2015 By The Napanee Beaver Issuu

7 Types Of Real Estate Contingencies And When To Waive Accept Inc